The latest mortgage rules: the good, the bad and the ugly and how it will impact your own mortgage

CMHC Insurance Premium Increase

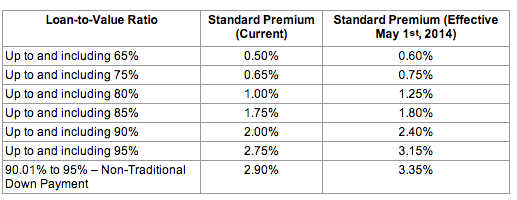

On February 28, 2014, CMHC announced mortgage insurance premium will increase effective May 1, 2014 for homeowners, self employed and 1-4 rental properties. Here is a chart of the current and new insurance premiums for owner occupied homes

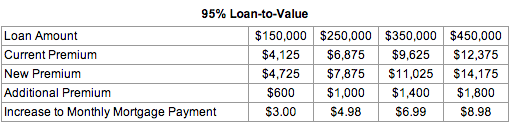

What exactly does this increase translate into dollars and cents? Here is an example based on 5% downpayment, 3.49% mortgage amortized over 25 years

As you can see the increase is moderate ($8.98 per month) and should be manageable by homebuyers. It will be interesting to see what happens in the future since CMHC stated they will review insurance premiums annually and make announcements in the first quarter moving forward.

Genworth wasted no time in announcing similar increases to their premiums effective May 1, 2014. Canada Guaranty took a few days to mull over their decision but they will increase their insurance premiums as well.

[contact-form subject='I Have A Question...'][contact-field label='Name' type='name' required='1'/][contact-field label='Email' type='email' required='1'/][contact-field label='Comment' type='textarea' required='1'/][/contact-form]

What Are The Closing Costs in Toronto?

Buying a home is an exciting and sometimes can be a nerve racking experience whether you are a first time home buyer or have owned multiple homes in the past. Getting excited about how to furnish the new home, fixing a few items, putting on a fresh coat of paint, addressing issues that came up in the inspection is part of the process. There are many costs to consider during the home buying process and they do add up.

Here is a list of costs to budget for at closing above and beyond the downpayment

Toronto & Ontario Land Transfer Tax

Two land transfer taxes are paid if one is buying in Toronto (Ontario & Toronto land transfer taxes). First time home buyers can be eligible for up to $2,000 credit from Ontario and $3,725 from the City of Toronto.

Legal Fees, Disbursements and Title Insurance

It is prudent to budget for $1,300 for legal fees and $300 for title insurance. HST is added to the legal fees.

Property Appraisal

If the mortgage is insured (less than 20% downpayment), the appraisal is covered by insurer (CMHC, Genworth or Canada Guaranty). In cases such as private sales, regardless of the downpayment, an appraisal will always be required. The cost of an appraisal is between $250 to $350 plus HST.

Other Costs

Once the home owner takes possession of the property, other costs to take into account are: moving costs, repairs, furnishings, utility setup and deposit fees. The repairs cost will vary depending on the condition of the home whether it is a fixer-upper or requires minor touch ups.

First Time Home Buyer? Buy A Duplex

Toronto's real estate market has been hot for so many years now and it is getting tougher for first time home buyers to enter the market for a few reasons:

Toronto's real estate market has been hot for so many years now and it is getting tougher for first time home buyers to enter the market for a few reasons:

- Mortgage rules restricting maximum amortization to 25 years with less than 20% dowpayment

- Home prices have increased faster than inflation and income rise

- Supply of homes (excluding high rise condos) such detached, semi-detached and townhomes is lower than demand, creating bidding wars in areas of Toronto

So how can you buy your first home?

First Time Home Buyer? Buy A Duplex

There are a number of properties in the city with a basement suite. Having rental income from the basement would offset some of the homeownership costs for first time home buyers. Here is a real example:

- Purchase Price: $447,000

- Downpayment: 5% ($22,350)

- Basement Rental Income: $850

- Monthly Mortgage Payment: $2,222.44 (10 year mortgage, 3.69% amortized over 25 years)

- Monthly Property Tax: $223

- Total Monthly Mortgage Payment and Property Tax Less Rental Income: $1,595.44

The first time buyer is living in a 3 bedroom/2 bathroom house for just under $1,600 a month. Yes, there are additional living expenses such as hydro, heat, cable, internet and home insurance, however for $1,600 a one bedroom plus den can be rented in downtown Toronto and there the additional costs of hydro, cable & internet. The first time home buyer is getting into the market and building equity into their home as opposed to paying their landlord's mortgage.

Using their RRSPs, through the Home Buyer's Plan, the first time home buyer is able to buy their first home.

You might be wondering why the first time home buyer chose a 10 year fixed mortgage. Since they plan on moving up the homeownership ladder within 4 to 5 years, they plan on renting their existing home (rent main unit & basement unit). With this strategy, they will avoid renewing the mortgage in 5 years at a higher interest rate which would eat into their monthly cash flow.

If you are first time home buyer, please contact Nawar to discuss how you can own a home and start building long term wealth through real estate.

Don't Payback Your RRSP Home Buyer's Plan!

RRSP Home Buyer's Plan is a great tool for first time home buyers to access money for the downpayment of their first home. The maximum allowed withdrawal is $25,000 per person which has to be paid back over 15 years. I will save the details of the RRSP Home Buyer's Plan for another blog post. Here is a controversial idea: Don't payback your RRSP Home Buyer's Plan back! Let me explain.

RRSP Home Buyer's Plan Scenario

- Mortgage amount: $300,000

- Interest Rate: 5% (mortgage rates are much lower now, but I want to use a reasonable interest rate over the life of the mortgage)

- Amortization: 25 years

- Required RRSP Home Buyer's Plan Payback: $138.89 monthly ($25,000/15 years/12 months per year)

My suggestion is not to payback into the RRSP but rather put the $138.89 into the mortgage above and beyond the normal monthly payment. If one pays $138.89 extra into the mortgage, after 15 years the results would be:

- Mortgage balance would be at $127,929 vs $164,894 (savings of $36,965 in principal and mortgage amortization is reduced to 22 years & 4 months from 25 years)

- 47.86% Return on investment: $25,000 of RRSP Home Buyer's Plan generated mortgage principal savings of $36,965

- First time home buyers saving 32 months of mortgage payment (25 years less 22 years & 4 months): $1,744 x 32 months = $55,808 which could be invested into RRSPs then

Since the first time home buyer is not paying the RRSP Home Buyer's Plan back, their income tax would rise by $1,666.68 ($138.89 x 12) annually. Assuming they are in the 45% income tax bracket, their income tax would rise by $750.

I realize this concept might be controversial and some might disagree with, but I hope the above numbers present a case for consideration. Paying down or paying off debt is an important step in achieving financial freedom. I would love to hear from you whether you agree or disagree.

Disclaimer: I am not a licensed financial planner and you should consult with your own financial advisor/planner prior to making any investment decisions. This is article is my personal opinion.

To discuss your personal mortgage financing needs whether you are buying a home, an investment property or renewing your mortgage, please contact Nawar.

How To Save on Your Land Transfer Tax

As mortgage lending rules have become more strict and real estate prices have appreciated over the last few years, it's becoming more challenging for some first time home buyers to qualify for a mortgage without a co-signer.

I was approached by a first time home buyer who was interested in buying her first home, a condo in downtown Toronto, and she needed her mother to co-apply in order to qualify for the mortgage. As a first time home buyer in Ontario, she would qualify for up to $2,000 land transfer tax rebate and up to $3,725 from the City of Toronto depending on her purchase price. Since her mother, who is a homeowner, is on title, the first time home buyer would have lost 50% of the rebates (since she's 50% owner in the property).

In order to save the buyer a few thousand dollars, with the lender's approval, the buyer was registered with 99% interest in the property and her mother with 1% interest. This setup allowed the first time home buyer to maximize the land transfer rebates available from the Province of Ontario and the City of Toronto.

It's important to work with a professional who is experienced and understands how to reduce their clients homeownership costs.

To discuss your personal mortgage needs, please contact me.

How I Ended Up With 2% Equity In My Home!

When buying a home with 5% downpayment, the mortgage has to be insured per Government requirement. The insurance premium is 2.75% (for 25 year amortization) or 2.95% (for 30 year amortization) which equates to the homeowner having 2.25% to 2.05% equity in their home at the day of closing. In the first few years of homeownership, the majority of the mortgage payment pays for the interest portion and minimal mortgage principal is paid down. It's important to keep in mind that if one is planning to move in 5 years (outgrow the 1 bedroom condo), once the costs (realtor fees, legal fees, downpayment requirement for new home & closing costs) are taken into account, the seller might find themselves to be short of funds which will mean they have to stay for a longer period of time in their current home.

It's important to have a plan to paydown the mortgage principal which fits a person's long term goals. Afterall, getting a mortgage, setting the payment and forgetting about it is not a sound approach to financial freedom.

To discuss your personal mortgage financing needs, please contact me.

2 Factors That Can Affect Your Home Value

Keep in mind the next time you are looking for a home or an investment property in a city, to take a look at job creation activities such as companies relocating or expanding, infrastructure investment or a city that is diversified in multiple industies. Afterall, having all the city's eggs in one basket is risky!

To discuss your personal mortgage needs, please contact me.

2 Factors That Can Affect Your Home Value

Toronto and GTA's real estate values have increased significantly over the last 10 years. The prices continue to increase as the global economy struggles to emerge out of the slowdown since late 2008. There are 2 factors that can negatively affect the housing market in Toronto, GTA as well as Canada: Interest rate and/or unemployment spike.

For the last 3 years, Canadian homeownerns and real estate investors have enjoyed historically low interest rates which have resulted in record sales and prices. Interest rates have remained low to stimulate consumer spending and promote GDP growth. As Canadians reach record debt levels (approximately $1.50 of debt to $1 earned), Canadians are running out of steam for further debt accumulation. Many Canadians have fixed mortgages in the 3.3%-3.8% and variable mortgages at the prime minus level.

In order to save the global economy from a depression, governments around the world took on aggressive stimulus (printing money) since late 2008 which will result in high inflation sometime in the future. As inflation becomes the primary objective of governments, interest rates will have to rise to control and moderate inflation. Canada is already experiencing high inflation numbers, however the Bank of Canada is choosing to keep its benchmark rate low due to the uncertainty originating out of Europe.

A spike in interest rates would effect Canadians since mortgages will renew at higher interest rates and unsecured loans would cost more. Based on August 2011 data, the affordability index in Toronto for 2 storey homes and bungalows is at 61.4% and 51.9% respectively (http://goo.gl/8rK5B). If one assumes that an income earner is taxed at 40%, it means that in order to buy a 2 storey or bungalow in Toronto, 2 incomes are required. Condos are a more affordable option in Toronto at 34.2%.

A spike in interest rates which diminish the ability of many to qualify for a mortgage especially insured since qualification is based on posted rates. Demand would therefore be reduced since less buyers can qualify for a mortgage.

The main point to take away from this post is to have a plan regarding mortgage/debt paydown and plan to renew ones mortgage at a 6% level. For more information, click here.

My next post will discuss unemployment spike.

What's Happening To Variable Mortgages?

What Was That Lender's Name Again?

Mortgage brokers promote dealing with 20 or more lenders. However, many homeowners only recognize the big 6 banks they have seen on street corners. So who are these other lenders that brokers promote? In Canada, approximately 25% of homeowners use the services of a mortgage broker. These lenders are Canadian owned and operated, but choose to fund their mortgages through the broker channel to cut overhead costs on "brick and mortar". Afterall, having full-time salaried employees with benefits cost money, not to mention the costs of operating a bank branch. Due to the reduction of expenses for the "non-bank" lenders, they tend to pass on the savings to borrowers through lower rates.

What are The Risks of Dealing With Non-Bank Lenders?

There is a mis-conception, especially after the financial credit crunch in late 2008, that borrowers will lose their homes if the mortgage is funded by a non-bank lender. This is absolutely not true. The risk is assumed by the lender since they are the ones giving out their money with the understanding the borrower will repay the mortgage on time. Also, keep in mind these lenders function under the Canadian Government rules and laws.

Why Should I Choose a Non-Bank Lender Over A Bank?

You don't have to. A non-bank lender is an option that is presented by your mortgage professional to consider. Other important factors to consider when choosing a lender are:

- How is the mortgage penalty calculated?

- If I decide to lock in, do I get the posted or discounted rate (typically 1.5% difference)?

- What features are built into the mortgage (pre-payment, increased payment, portable, assumable...)?

- What are the fine print terms that I should be aware of?

- Who & how will my mortgage be managed? Afterall, getting a mortgage is one thing but working with someone who will oversee the mortgage and optimize it to reduce overall interest is another skill (click here for inflation hedge mortgage strategy)

Bottom line, if you pay your mortgage on time no on will take your home away! This is Canada afterall.

To discuss your personal mortgage financing situation, please contact me.

How You Can Buy A Home With $24.95?

A client approached me a few weeks back with interest of getting pre-qualified for a mortgage to buy their first home. During our initial meeting, we discussed their goals, where they see themselves in 5 years and cash flow projections based on mortgage interest rates over the next 5 years. One of the questions I ask, is how the person's credit score is. The client stated they had no outstanding debt with very little credit card balance that is paid off every month. Once all the necessary information was gathered, a credit check was completed and I was shocked to what I saw in their report. There was an outstanding student loan which showed delinquency for over 21 months which literally had destroyed the client's credit score and history. I contacted the client to notify them of the issue and they were surprised to hear there was a balance since they stopped receiving a bill after they moved to their new address. They had thought the loan was paid off. Unfortunately, the outstanding balance was minimal but had accumulated lots of interest over the 21 months.

In this case, the client will have to re-establish their credit and show 2 years of good credit history to qualify for a mortgage at a decent mortgage interest rate. There are other alternatives, but are more costly.

By checking your own credit score annually from Equifax (http://goo.gl/5xqCP) these type of issues would be resolved. Similar to a medical annual check up, an annual credit check is important to verify there aren't any errors or items that need to be addressed immediately. The cost of checking your credit score is $24.95.

To discuss your personal mortgage financing needs, please contact me.

Why Ultra Low Mortgage Rates Are Not Good?

We have experienced low mortgage rates since the financial credit crisis in late 2008. The purpose of the low rates is to stimulate consumer spending which will result in economic growth and recovery out of the recession. In the last few weeks, there have been talks regarding the European debt crisis and how similar it looks like the 2008 credit crisis. It started with Ireland and Greece, which are considered small economies in Europe. The credit crisis talks have shifted to Spain and Italy which are large economies. As Germany and France continue to bailout their Euro zone counterparts, they accumulate more debt. There were talks last week that France is in financial trouble which resulted in a stock market sell off among other bad economic news. The bottom line there is a storm brewing in Europe which will come to fruition sooner or later. This uncertainity has resulted in bond yields dropping to historic lows which will result in lower fixed mortgage rates.

There are now possibilities the Bank of Canada might hold or even consider cutting its benchmark rate (which sets prime rate) to stimulate the Canadian economy just in case Canada gets dragged into a slowdown due to what's happening in US & Europe. This means continued low rates for the foreseeable future.

So What You Might Ask?

The concern with even lower interest rates, is creating more demand in the Canadian real estate market. This is good news for first time home buyers since the affordability requirements will drop, however, more bidding wars might result (I can only comment on Toronto's real estate market since this is where I conduct my business) and some would lose out. Canadian household debt is already at an all time high and taking on further debt could result in an unpleasant consequences for all (http://goo.gl/zzcDH). The lower rates will pull the future demand into the present and leave a void in the future. The other concern is Canadians getting used to these low mortgage rates and not plan for higher interest rate environment when mortgages renew in a few years from now.

Finally, taking on debt with a responsible plan to pay if off can be a good thing. However, taking on debt and not planning for higher interest environment will have dire consequences.

To discuss your personal mortgage financing situation, please contact me.

Are Mortgage Interest Rates Dropping?

The Roller Coaster Market And Your Mortgage

It has been a roller coaster for the last few days in the market! There has been a lot happening over the last month or so in the global economy which has resulted in some serious volatility in the market (stocks & bonds).

The majority of homeowners, unfortunately, get a mortgage from their local branch, set the payment and forget about it till renewal. I call it "set it & forget it" approach. Since 2008, there has been a lot volalitility which is anticipated to continue as the western economies deal with unprecedented levels of debt. Here is a number to put things into perspective: Between today and September 1, 2011, European countries have to pay 57 billion euros of interest! These numbers will have a huge impact on the recovery of Europe, not to mention the US which is dealing with its own fiscal challenges.

Why Should You Care?

A mortgage, whether it is for a home, cottage or rental property is an investment vehicle. Similar to one's RRSPs, which I am sure lots of Canadians are now reviewing on a daily basis, a mortgage needs to be reviewed on a regular basis to optimize it for what's happening in the economy. This means someone overseeing the mortgage, notifying the borrower when to adjust the mortgage payment to reduce the mortgage amortization and save thousands of interest dollars as well as adjusting the mortgage for renewal at a higher interest environment. These low rates will not be around forever. The beauty of all this after mortgage funding service, is it comes at no cost to the borrower from a mortgage professional, believe it or not. Unfortunately, the majority of homeowners don't utilize this free service.

This is a great opportunity for Canadian homeowners to take advantage of this low interest rate environment and set up a plan to achieve mortgage freedom and save thousands of unnecessary interest dollars. Afterall, it is your hard earned dollars!

To discuss your personal mortgage finance situation, please feel free to contact me.

My Commentary On What The Bank Of Canada Said Today

What's Your Best Interest Rate?

Typically, one asks for the best mortgage rate when looking for a mortgage. In this video, other questions to be considered are discussed to help one decide since a mortgage is an investment vehicle not a commodity.

Where Is Prime Rate Going?

Why Fixed Rates Move So Much?

Are You Ready For 6%?

Today's mortgage rates remain to be extremely low due to the uncertainity in the global market (risk of Greece defaulting), anemic job creation in the US and massive government debts and deficits. In Canada, we have been lucky not to experience the pain of our neighbours to the south or across the pond in Europe. Fixed mortgage interest rates are hovering in the mid to high 3% which are historically low. Over the last 25 years, fixed rates average around 6% (see chart below which shows posted rates. Typically, there is 1.5% difference between posted and discounted)

It is important to budget ahead for the time when mortgages are up for renewal at the 6% level. Inflation hedge strategy, is a pro-active plan where the mortgage is reviewed annually and adjusted according to the projected renewal rate. This strategy saves the borrower thousands of interest dollars and accelerates paying down the mortgage principal. At renewal, the borrower's mortgage balance is reduced and adjusted for higher interest rate environment eliminating any payment shock.

For variable mortgage holders, the savings are even greater, since the mortgage is paid at the fixed interest rate level which contributes more monies towards paying down the mortgage principal.

For your personal mortgage review and inflation hedge analysis, please contact me.