New mortgage rules are in effect as of December 1, 2016 and you will need a mortgage broker to navigate through the maze of mortgages

The Latest Mortgage Rules: The Good, The Bad & The Ugly

4 Reasons Why Government Will Step In To Cool Off Toronto's Real Estate Market

What Is The Mortgage Qualifying Rate (MQR)?

The mortgage qualifying rate is used to qualify all variable mortgages and fixed mortgages of 1-4 year term. The Bank of Canada updates the mortgage qualifying rate (MQR) every Monday at 12:01am. 5 year fixed or longer fixed terms qualify using the contract rate (the actual borrowing rate). Here is an explanation:

Mortgage Qualifying Rate Example

Assumptions

- Household income: $100,000

- Assume 20% downpayment

- Freehold home, no condo fees

- 5 year fixed mortgage 3.19% amortized over 30 years

- 5 year variable mortgage at prime - 0.5% amortized over 30 years

- Mortgage qualifying rate (MQR): 4.99%

Maximum fixed mortgage: $577,000 (Purchase price: $721,250) Maximum variable mortgage: $466,000 (Purchase price: $582,500)

One way to increase the purchase power of a variable or fixed mortgage is obtain a 35 year amortized mortgage. Once the homeowner takes possession of the home, they can set the payment at the 30 year amortization level to avoid paying additional interest over the life of the mortgage.

To find out what you qualify for and a have a winning strategy for bidding wars, please contact Nawar.

CMHC Insurance Premium Increase

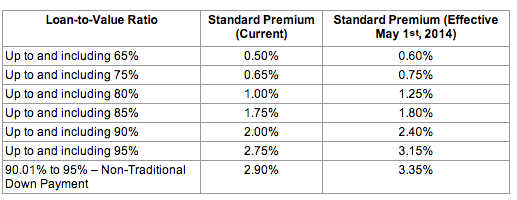

On February 28, 2014, CMHC announced mortgage insurance premium will increase effective May 1, 2014 for homeowners, self employed and 1-4 rental properties. Here is a chart of the current and new insurance premiums for owner occupied homes

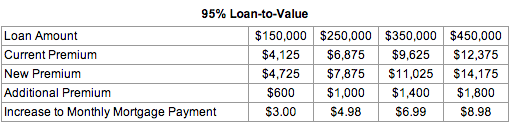

What exactly does this increase translate into dollars and cents? Here is an example based on 5% downpayment, 3.49% mortgage amortized over 25 years

As you can see the increase is moderate ($8.98 per month) and should be manageable by homebuyers. It will be interesting to see what happens in the future since CMHC stated they will review insurance premiums annually and make announcements in the first quarter moving forward.

Genworth wasted no time in announcing similar increases to their premiums effective May 1, 2014. Canada Guaranty took a few days to mull over their decision but they will increase their insurance premiums as well.

[contact-form subject='I Have A Question...'][contact-field label='Name' type='name' required='1'/][contact-field label='Email' type='email' required='1'/][contact-field label='Comment' type='textarea' required='1'/][/contact-form]

How To Find A Trustworthy Mortgage Broker?

Referrals are still the primary method of getting introduced to a mortgage broker when buying a home or an investment property, however more and more Canadians are searching for mortgage brokers online. Borrowing hundreds of thousands of dollars is a serious undertaking and requires due diligence. Based on my years of experience here is a checklist of how to find a trustworthy mortgage broker.

Trustworthy Mortgage Broker Checklist

Online Presence: Everyone, well pretty much everyone, has a website nowadays. However, are they active in publishing material relevant to the market? Are they experts in a niche market (real estate investment, self employed, first time home buyers, bad credit, private mortgages....) or are they the jack of all trades? Going through their website you will get a good feel if they are experts in a specific field.

Strategy vs No Strategy: Quoting rate requires no skills, afterall most brokers and lenders have the same rates with a possible difference of up to 0.1% ($100 for every $100,000 per year). Unfortunately, obtaining a mortgage licence is easy; one course, a few hundred dollars and off you go! If a broker or agent is only quoting rates without explaining the following, run away:

Pros and cons of each product

How each product helps you achieve your financial goals

Fine print terms (penalties, mortgage features)

A plan to pro-actively manage the mortgage post funding

Execution: A financial planner engages their clients on an ongoing basis to adjust their portfolios as economic conditions and clients' lifestyle change, why wouldn't you expect the same from your mortgage broker? Building net worth is achieved through 2 ways: 1/ increasing assets and 2/ decreasing bad debt. How will the mortgage broker track your mortgage and keep you informed? Why not have a debt manager on your team?

Full Time vs Part Time: Since mortgage agents have a low barrier of entry, there are some out there who operate on a part time basis. There is nothing wrong with someone building their business to transition full time into the profession, but would you trust a part time lawyer, a part time doctor, a part time real estate agent or a part time contractor?

Experience: I'm into sports, so I'll use a sports analogy: great coaches used to be players in the past. If you are looking to invest in real estate, shouldn't you engage a mortgage broker who invests in real estate, whose been through the ups and downs? If you are self employed, shouldn't you approach a full time self employed mortgage broker who personally experienced the challenges of getting mortgage financing? If you are a first time buyer, shouldn't you meet with a mortgage broker who had a terrible experience getting a mortgage for their first home?

Job Interview: I view hiring a mortgage broker as applying for a job. You probably can recall going for a job interview, where the interviewers asked lots of questions and based on your answers (and references) got a gut feel for you. Hiring a mortgage broker is the same, use the above information to ask questions and get a good gut feel for who you should hire. You are trusting a professional with hundreds of thousands of dollars.

If you are buying your first home, an investment property or you are self employed and looking to interview a professional mortgage broker, please contact me.

3 Tips When Renewing Your Mortgage

I have to share this personal experience since it resembles what I deal with on a daily basis with my mortgage clients. My home and auto insurance policies have been with a company for years now until I got my renewal letter a few weeks ago. The jump in insurance premium caught my attention especially since my wife and I are responsible drivers: we have 2 young children, and our records have been impeccable; no tickets, no violations, no accidents.....Usually I get my renewal, go through it to ensure there aren't major changes, the price is reasonable based on the previous premium and then renew.

Sounds familiar? You get your mortgage renewal, too busy with kids, work and life, numbers look ok and you renew? I wasn't happy with the increase in premium and decided to look around.

I tried a price comparison site which provided a low price but after connecting with the insurance company it turned out the information transferred to them from the rate site was inaccurate and the quoted price was invalid; it was higher.

Sounds familiar? You check out a mortgage rate site to find out the rates being quoted are for 30 day closings, have restrictive conditions, not valid for rental properties, you can't refinance the mortgage in the future.....and the list goes on.

By investing some time I saved 25% off what was offered by the existing insurance company.

3 Mortgage Renewal Tips

Don't sign the renewal letter sent by your incumbent lender

Rate sites provide a number but don't tell the full story

Take the time to consult with a professional, it could save you thousands of dollars

In my business, new and repeat clients are provided with superior service and their business is never taken for granted. I don't understand why some businesses take their existing clients for granted.

If your mortgage is up for renewal, you don't want to be taken for granted and looking for professional unbiased advice, please contact me.

Don't Buy An Investment Property For Cashflow!

You are probably thinking "What is he saying, especially since he always talks about buying an investment property is buying a business". You are correct, buying an investment property is buying a business. Here is what I mean: A property is purchased at $625,000 with a mortgage of $500,000 (80% loan to value), borrowed at 3.99% for a 10 year term amortized over 35 years. Rental income for the duplex is $3800 per month, which nets $800 after taking into account 10% safety (for repairs & maintenance as well as vacancy).

There are 2 options when it comes to using the surplus:

- Increase the mortgage payment by $800 per month

- Use the lump sum feature to pay down the mortgage $800 every month or at a set frequency (quarterly or semi-annually)

If the real estate investor is planning to acquire more properties, option 2 is best, since increasing the mortgage payment would hinder qualification of further properties. The pre-payment feature would accomplish the same result without sacrificing the ability to qualify for more investment properties.

Let's dig deeper into the numbers:

If the mortgage is pre-paid by $800 every month, the mortgage amortization would drop from 35 years to 20.25 years! Imagine what would it feel like if you owned your investment property free and clear 15 years ahead of schedule and what that additional income would do to your lifestyle.

The next time you are buying an investment property, don't buy it to use the cashflow for personal expenditure, rather use it to payoff the mortgage.

Every real estate investor has unique goals, to discuss your personal real estate investment portfolio and goals, please contact me.

How To Get Your Renovations On Budget And On Time

Recently I completed a renovation job of a duplex investment property in the upper beach area. Yes, I was on time and on budget! I have been approached by a few people who wanted to know how did I get a 3 month, $100k renovation job right on budget and on time. The answer is simple: plan, communicate and trust. Plan As a retired Engineer who spent 10 years as a project manager, I gained valuable skills in managing projects. Initially, when I viewed the property of interest, I brought in my contractor to show him the scope of work I intended to do and my vision for the property once completed. We sat down and created a timeline with contingency factored in over the 3 month period. Based on the timeline and required manpower, he was able to complete his quotation. During the renovation period, I had weekly reviews with my contractor to see where we were per the timeline and if there were any issues that we didn't plan for. An important factor I was always 2-3 weeks ahead in having materials ready to avoid a situation where work would stop since they didn't have tiles or vanities or kitchen....

Communicate I stopped by the property 3-4 times a week in the first month, 2-3 times in the second month and 1-2 time in the last month to communicate with the contractor and subcontractors (HVAC, electrician, plumber...). I also clearly stated to the team what I wanted and how I wanted certain things to save them the time/money of redoing the work.

Trust You might be wondering what does trust have to do with renovations. In my opinion, it's very important since I trusted my contractors' skills to do an excellent job and I trusted the professionals that were referred to me. By trusting the contractor and subcontractors, I gave them the space and confidence to do the job without micromanaging and being overbearing. Imagine you being at work and your boss pops in every half an hour to see what you are doing. I'm sure it would drive you crazy! I choose to treat my team the way I like to be treated.

We did have problems and challenges, we dealt with them and got the job done on time and on budget.

I hope you find this blog post helpful and if you ever need to connect with my trusted team (contractor, electrician, realtor....) or to discuss financing your home/investment property renovations, please contact me.

Do US Elections Impact Canadian Mortgage Rates?

Over the last month or so, I have heard some mortgage brokers promoting the 4 year fixed rates to their clients since it coincides with the US presidential cycle based on the argument that in US election years, mortgage rates remain low for the incumbent President to be re-elected. As a mortgage broker who is driven by data and facts, I had to do some research to justify these statements. Before we dive into data, let's understand what drives mortgage rates:

- Fixed rates are driven by the bond market which moves up and down based on economic news. Good news drive the bond yields higher, therefore increasing rates and vice versa; bad economic news drive the bond yields lower therefore reducing fixed mortgage rates.

- Variable mortgages are driven by prime rate which is set by the Bank of Canada (independent of government) and the discounts on prime are driven by liquidity and credit risk factors. In good times, variable mortgages were at prime-0.8%, during the financial meltdown of late 2008, variable mortgages were at prime+1%

How To Use A 40 Year Mortgage To Payoff A Mortgage In 20 Years

You might be thinking can I really use a 40 year mortgage to payoff a mortgage in 20 years. The answer is yes. Here is a real example of a recent client case that I helped structure: Client has one rental property which he was paying down aggressively by taking all the net cash flow ($400 monthly) and putting it down on the principal. This might sound like a good idea, however it is inefficient. Here is why:

- Paying down an investment property aggressively reduces interest portion of mortgage payment which is tax deductible, therefore resulting in higher taxable income

- Net positive cash flow can be used to pay down non tax efficient debt (home mortgage)

The solution for the client was the following:

- Leave the investment property mortgage at its original 40 year amortization (which is still available for conventional mortgages)

- Use the net positive cash flow ($400 per month) to paydown principal residence ($300,000 mortgage amortized over 30 years at 3.29% is reduced to 20 years of amortization saving $62,461 of interest payments)

The cash repositioning helped the client paydown their principal residence, save thousands of interest dollars and be tax efficient. It is important when choosing a mortgage for your investment property, the right product is selected that will fit into your long term goal. Please consult with your accountant regarding your taxes.

In conclusion, there is more to mortgages than rates. If a mortgage product is used properly, mortgage freedom can achieved faster which is the goal of many homeowners.

To discuss your personal mortgage situation, please contact me.

How To Get A Mortgage If You Are Self Employed

Starting a business is rewarding and challenging. Entrepreneurs put their heart and soul into growing the business and wear multiple hats in running their operations. Understanding the impact of being self employed on getting a mortgage is not a top priority for entrepreneurs. There are options that exist for self employed borrowers but not as many options as someone who is full time salaried employee. There are 3 factors in determining which mortgage option suits the business for self borrower:

- Length of time being self employed: Being self employed for more than 2 years provides more mortgage options.

- Amount of downpayment available for mortgage financing: Increased equity into the property reduces lenders' risk and provides security since the borrower has sweat equity invested into the property. There are mortgage products with as little as 10% downpayment for buying a home & 85% for refinancing.

- Credit score: Having a 680 credit score or higher with excellent credit track record is beneficial

Risks Of 5 Year Fixed Mortgages

Have rates ever been this low? With historic lows for the 5 year and 10 year terms, it is very enticing to take advantage of today's low interest environment. The question is whether one should go for 5 or 10 year. Before I answer the question, consider the following:

US Federal Reserve stated its benchmark rate will remain at or near zero till the end of 2014

Canadian household debts is at an all time high and will continue to increase since Bank of Canada has to remain close enough to the US Federal Reserve benchmark rate, otherwise the Canadian dollar will skyrocket negatively affecting exports in a sluggish global economy

Governments around the world have been "stimulating", printing, money since late 2008 to get the global economies growing again which has lead to high government debts and deficits. Basically, governments are carrying the load until the private sector feels it is their time to start spending again.

The European zone is in crisis and it is taking on huge amounts of debt by bailing out countries

These factors will eventually lead to inflation, but when will it happen? in 2015? 2016? 2020? No one really knows, but it will happen. In my opinion, the longer the rates remain superficially low, the more aggressive the increases will be to control inflation.

Homeowners who are taking on or renewing their mortgages in 2012 will renew in 2017 (if they take a 5yr term). Based on the fact the US Federal Reserve will keep its rate at or near zero and the Bank of Canada will stay relatively close till end of 2014, it is likely aggressive rate increases will commence in 2015 to control inflation and slow down Canadian household debt.

Today's 10 year fixed mortgage term is at an all time low and provides a good protection from economic and rate shocks. Consider this: would you take a 5 year fixed at 3.99% in 2017? What's the risk of a 10 year term one might ask? The mortgage is portable and assumable and the day after the 5 year anniversary, the penalty is based on 3 month interest NOT interest rate differential. I believe it is a great time to consider a long term safe mortgage strategy. To run your personal mortgage analysis comparing 5 year term versus 10 year term, please contact me.

How To Increase Cash Flow In An Investment Property

In a hot Toronto real estate market where sellers are getting what they want (and sometime more), finding investment property opportunities requires a skill and having good team members. In my search for a duplex or triplex, I focused on the Beach / Upper Beach area where the tenant profile is strong and potential for long term appreciation is in place. We found a duplex that generated $2,500 monthly income, however it had potential for higher rents once the property was updated. Here is a video shot by my realtor, Andrei Angelkovski (www.BeachInvesting.com), who specializes in investment properties in the Beach area, walking through the property and explaining the work to be done. I'll be posting updates over time showing the progress and explaining why certain things were done. http://youtu.be/1QUw_tvVwNc

Happy Investing!

To discuss your personal investment property goals and opportunities, please contact me.

How To Beat 2.99% 5 Year Mortgage Rate

Bank of Montreal's 2 week promotion of 2.99% 5 year fixed rate has initiated a flood of emails from lenders lowering their interest rates on various mortgage terms. Yes, the gloves are off since we are back from the holidays and the real estate market is active again. Can this rate be beat? The answer is yes if one looks at a longer term. Here is a scenario I ran for clients today based on a $250,000 mortgage:

Option 1: 10 year fixed 3.89% amortized over 30 years.

Option 2: 2.99% 5 year fixed amortized over 25 years, renew at normal interest environment of 5.75% for 5 years (click here for historical chart).

For both options, the monthly payments are set exactly the same over the 10 year period. Here is a screen print of the comparison chart:

Summary:

- Option 1 home equity after 10 years: $75,706 (10 year fixed results in additional equity)

- Option 2 home equity after 10 years: $69,576

- Payment shock with option 2: $310 per month when renewing from 2.99% to 5.75%

- With inflation hedge mortgage strategy, additional equity would be obtained with option 1

In conclusion, mortgage rate is important, however looking at the long term picture and minimizing the cost of homeownership is key.

To discuss how you can be mortgage free sooner, please contact me.

Don't Get Hung Up On The Dollars When Investing In Real Estate!

I recently met with a client who wants to invest in real estate. In the initial meeting where I find out about the client's long term goals, desired mortgage freedom date, why they want to invest in real estate and how many properties they plan to acquire, the client stated their criteria is to have $400 or more in cash flow on a monthly basis.Cash flow is key in investing in real estate, however I was perplexed since they only wanted to invest $50k. Based on my quick calculations (downpayment is 20% therefore total purchase price is $250k and using 8% gross rental income rule, the property would generate $20k annually or $1,667 monthly), it would be very difficult for a property to cash flow 20+% of gross rental income (in this case it's $400/$1,6667 = 23%).

Real estate investors want to maximize cash flow which is a great goal, however, it's important to consider ratios since an investor with $100k capital will generate more cash flow than someone with $50k capital, and an investor with $150k capital will generate more cash flow than someone with $100k capital.

Click here to see a comparison between 2 properties ($240k vs $500k) based on 2 actual investment property listings that I have recently come across illustrating the ratios (CAP rate, DCR, cash on cash...) are very similar to each other although the cash flow is double for $500k property.

Investing in real estate is about cash flow and ratios as well.

To discuss your real estate investment goals, please contact me.

Turn Down The Noise And Take Action

A new year is upon us and we are hearing the same things: "Real estate is overvalued by 10%, 25%...", "We are due for a correction".... I agree that real estate prices, and I'll only speak for Toronto since this is where I live and conduct my business, have appreciated over the last few years, however, one can't generalize since real estate is very local. As per my previous posts "2 Factors That Can Affect Your Home Value", interest rates spike or unemployment spike are the 2 factors that can derail real estate prices. The other factor, is some major global disaster such as a country defaulting on its debt, would affect everyone and everywhere.There is lots of information on TV, radio, newspaper and on the internet. It can be overwhelming and paralyzing.

I am a firm believer in putting a plan together and taking action. Since it's early in the year, it's a great time to put a financial plan (when you want to be mortgage free or think about buying an investment property to create long term wealth or topping up your RRSPs or consolidating debt to improve cash flow) then take action. It's best to look back at year end and be grateful for taking action this year as opposed to wishing had done something 12 months earlier.

Please feel free to contact me to discuss your personal mortgage and financial goals.

How BAR Can Grow Your Real Estate Investment Portfolio

BAR?? Yes BAR, which stands for buy, add value and refinance. The toronto real estate market is hot and finding good deals can be a challenge especially when supply is low and there are quite a few interested buyers (I wonder how many are frustrated with their stocks and have decided to invest into real estate). A property that shows well in a good area will probably go for over asking or very close to asking price. I have come across listings where the sellers were disappointed for not getting multiple offers which resulted in increasing the listing price the next morning!

It can be frustrating since real estate investment is about numbers and not getting emotionally attached to a property. Working with a realtor who specializes in real estate investment is critical since they are knowledgeable in a local area, know local rents and understand how to add value to a property to create additional income.

Here is an example of a property I came across in Toronto: a 2 bedroom, 2 bathroom semi-detached with a finished basement in the "beach". The potential was to separate the main floor from the basement (creating an additional income suite) and adding a powder room w/ laundry on the main floor. The strategy is to create a second income suite up to code and refinance the property once the renos are complete to recover the renovation costs. This accomplishes the following:

- Increase property value

- Increase rental income (2 incomes versus 1)

- Create positive cash flow property

BAR (buy, add value & refinance) is one strategy for real estate investors to create long term wealth. It's key to have a strong experienced team (realtor, mortgage broker, contractor and other trades) who understand what the objective are and have done work for real estate investors.

To discuss your personal real estate investment portfolio or questions regarding real estate investment, please contact me.

How I Ended Up With 2% Equity In My Home!

When buying a home with 5% downpayment, the mortgage has to be insured per Government requirement. The insurance premium is 2.75% (for 25 year amortization) or 2.95% (for 30 year amortization) which equates to the homeowner having 2.25% to 2.05% equity in their home at the day of closing. In the first few years of homeownership, the majority of the mortgage payment pays for the interest portion and minimal mortgage principal is paid down. It's important to keep in mind that if one is planning to move in 5 years (outgrow the 1 bedroom condo), once the costs (realtor fees, legal fees, downpayment requirement for new home & closing costs) are taken into account, the seller might find themselves to be short of funds which will mean they have to stay for a longer period of time in their current home.

It's important to have a plan to paydown the mortgage principal which fits a person's long term goals. Afterall, getting a mortgage, setting the payment and forgetting about it is not a sound approach to financial freedom.

To discuss your personal mortgage financing needs, please contact me.

2 Factors That Can Affect Your Home Value

Keep in mind the next time you are looking for a home or an investment property in a city, to take a look at job creation activities such as companies relocating or expanding, infrastructure investment or a city that is diversified in multiple industies. Afterall, having all the city's eggs in one basket is risky!

To discuss your personal mortgage needs, please contact me.