With fixed mortgage rates rising quickly in the last few weeks, is it finally time to lock in your variable mortgage?

The New World of Mortgages

3 Reasons Why Mortgage Rates Went Up

The Latest Mortgage Rules: The Good, The Bad & The Ugly

It Just Got A LOT Tougher To Qualify For A Mortgage

4 Reasons Why Government Will Step In To Cool Off Toronto's Real Estate Market

3 Steps To Winning Bidding Wars In Toronto's Real Estate Market

How To Get The Lowest Mortgage Rate

Oil Prices and The Battle of Fixed vs Variable Mortgage

Your mortgage is up for renewal or you just bought a home and it is time to decide: fixed mortgage or variable mortgage. Both options are at historic lows, which sounds like a broken record since the economic collapse of 2008. With 5 year fixed rates hovering around 2.89% and variable mortgages at prime less 0.6%, either option is attractive. But how do you choose? The answer is in oil prices.

With oil prices collapsing from $140 per barrel to $45-$50 range in the last 6 months, Canada's GDP growth will slow down and there are talks of Alberta going into recession, yes the "R" word. Over the last 4 years, Alberta has been carrying the country with its economic growth. As Alberta slows down, inflation will be lower, unemployment will be higher (in Alberta, NewFoundLand and Saskatchewan).

Slower economic growth (GDP and employment) will lead to lower inflation, below 2-3% target range for the Bank of Canada which would keep prime rate at current levels. If the economy shrinks, the Bank of Canada will cut prime rate to stimulate economic growth (as I write this post, the Bank of Canada has surprised the market by cutting the benchmark rate by 0.25%. Effective tomorrow, prime rate is 2.75%!)

Until the economy returns to "its full capacity" which the Bank of Canada is predicting to be late 2016, or later in my opinion, the benchmark rate which drives prime rate will probably not increase till then.

So, as oil prices go, so does the Canadian economy.

What Is Mortgage Increase And Blend?

Homeowners are taking advantage of historic low interest rates whether they are fixed, around 3%, or deeply discounted variables around prime less 0.5%. Majority of homeowners and real estate investors choose a 5 year term, but what happens in the future if it is required to increase the mortgage amount for the purpose of debt consolidation, equity take out for investment purposes, or moving to a new home?

Home Equity Take Out Options

Example: Property value $480,000. Current mortgage balance is $250,000 at 3.09% with 3 years remaining till maturity and the homeowner wants to borrow $150,000 to buy an investment property. There are 3 options for the homeowner to entertain:

- Break the mortgage and restructure up to 80% based on current market value. Con: paying a penalty and refinancing at a higher interest rate (assuming interest rates will not be at 2.99% in 3 years time)

- Add a HELOC up to 80% of current market value: HELOCs are offered at prime+0.5%. Good option since it is setup separately and interest costs can be easily tracked for income tax deductions

- Increase & blend: Leaving the current mortgage at 3.09% unchanged, the homeowner can add another $150,000 to the mortgage based on current mortgage interest rates with the new mortgage maturing at the original date. In this case, a 3 year fixed term would the product choice.

The above illustrates the options for a fixed mortgage holder. The options are different for variable mortgage holders:

- Refinancing the mortgage with the penalty being 3 month interest

- Adding a HELOC up to 80% of current home value

- Increase and blend is not an option lenders offer. To my knowledge only one lender allows increase and blend for variables. ING Direct used to allow it, however that might have changed after the acquisition by Scotiabank and renaming to Tangerine

One thing to look out for is the fine print detail for no frills mortgages (ultra low rates) as some might restrict the homeowners ability. For example, BMO's 2.99% offer allowed the homeowner to refinance only with BMO and did not allow adding a HELOC. Since the homeowner has no negotiating power they are at the mercy of the bank when it comes to interest rates.

There is more to mortgages than interest rates. Rates are the cost of getting into the mortgage, however the fine print can cost thousands more.

To navigate through the mortgage minefields and for a hassle free transparent experience please contact Nawar.

The Fine Print Of 2.99% Mortgage Rate

It is that time of year again....spring market. This is when the majority of real estate transactions occur and hence when the banks tend to get aggressive on mortgage pricing to gain market share. Another 2.99% offer was made by BMO which was in the headlines across various media outlets. My objective in writing this article is to explain the fine print of BMO's mortgage. In 2014 homeowners ought to expect more transparency and explanation from their mortgage professional or bank employee.

Here are the fine print details of the 2.99% offer:

- 25 Years Maximum Amortization: It is advantageous to payoff your home early, however one size does not fit all. If the homeowner, intends to buy an investment property, cottage or a second home in the future, the higher mortgage payment due to the lower amortization would restrict mortgage qualification. Other cases where 25 year amortization is disadvantageous are: self employed homeowner, family that's expecting a child and income will drop due to maternity leave, family that has to support a child through university, single parent, homeowner who is looking to leave their job and start a business......

- Pre-Payment Privileges: 10%. Although the majority of lenders offer 15%-20% pre-payment privileges, I believe 10% is decent since majority of homeowners do not max out that privilege

- Increase Payment Privilege: 10%. Decent but again, not the best in the industry (15%-20%).

- Fully Closed Term: This is where BMO has their clients locked up. The homeowner can get out of the mortgage if they sell the home via bona fide sale (arms length sale) or refinances with BMO. In negotiations, if one has only option or entity to negotiate with they would not be in position to get a good deal. The interest rate differential (IRD) for this mortgage product is punishing since it is 2% below the posted rate (4.99%) and it's equivalent to approximately 4% of the outstanding balance.

It is important for homeowners to sit with their mortgage professional and ask about the cost of getting into the mortgage (interest rate) and inquire about the costs of getting out of the mortgage (penalties, portability, restrictions). A mortgage is one piece of the puzzle in a homeowner's financial plan and it is important to ensure the right product is chosen based on features and not just rates.

CMHC Insurance Premium Increase

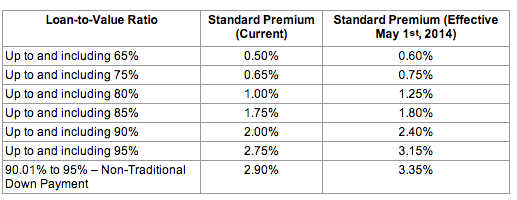

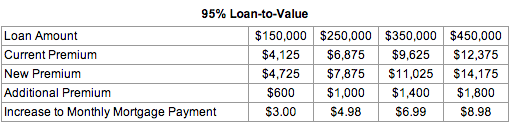

On February 28, 2014, CMHC announced mortgage insurance premium will increase effective May 1, 2014 for homeowners, self employed and 1-4 rental properties. Here is a chart of the current and new insurance premiums for owner occupied homes

What exactly does this increase translate into dollars and cents? Here is an example based on 5% downpayment, 3.49% mortgage amortized over 25 years

As you can see the increase is moderate ($8.98 per month) and should be manageable by homebuyers. It will be interesting to see what happens in the future since CMHC stated they will review insurance premiums annually and make announcements in the first quarter moving forward.

Genworth wasted no time in announcing similar increases to their premiums effective May 1, 2014. Canada Guaranty took a few days to mull over their decision but they will increase their insurance premiums as well.

[contact-form subject='I Have A Question...'][contact-field label='Name' type='name' required='1'/][contact-field label='Email' type='email' required='1'/][contact-field label='Comment' type='textarea' required='1'/][/contact-form]

How To Find A Trustworthy Mortgage Broker?

Referrals are still the primary method of getting introduced to a mortgage broker when buying a home or an investment property, however more and more Canadians are searching for mortgage brokers online. Borrowing hundreds of thousands of dollars is a serious undertaking and requires due diligence. Based on my years of experience here is a checklist of how to find a trustworthy mortgage broker.

Trustworthy Mortgage Broker Checklist

Online Presence: Everyone, well pretty much everyone, has a website nowadays. However, are they active in publishing material relevant to the market? Are they experts in a niche market (real estate investment, self employed, first time home buyers, bad credit, private mortgages....) or are they the jack of all trades? Going through their website you will get a good feel if they are experts in a specific field.

Strategy vs No Strategy: Quoting rate requires no skills, afterall most brokers and lenders have the same rates with a possible difference of up to 0.1% ($100 for every $100,000 per year). Unfortunately, obtaining a mortgage licence is easy; one course, a few hundred dollars and off you go! If a broker or agent is only quoting rates without explaining the following, run away:

Pros and cons of each product

How each product helps you achieve your financial goals

Fine print terms (penalties, mortgage features)

A plan to pro-actively manage the mortgage post funding

Execution: A financial planner engages their clients on an ongoing basis to adjust their portfolios as economic conditions and clients' lifestyle change, why wouldn't you expect the same from your mortgage broker? Building net worth is achieved through 2 ways: 1/ increasing assets and 2/ decreasing bad debt. How will the mortgage broker track your mortgage and keep you informed? Why not have a debt manager on your team?

Full Time vs Part Time: Since mortgage agents have a low barrier of entry, there are some out there who operate on a part time basis. There is nothing wrong with someone building their business to transition full time into the profession, but would you trust a part time lawyer, a part time doctor, a part time real estate agent or a part time contractor?

Experience: I'm into sports, so I'll use a sports analogy: great coaches used to be players in the past. If you are looking to invest in real estate, shouldn't you engage a mortgage broker who invests in real estate, whose been through the ups and downs? If you are self employed, shouldn't you approach a full time self employed mortgage broker who personally experienced the challenges of getting mortgage financing? If you are a first time buyer, shouldn't you meet with a mortgage broker who had a terrible experience getting a mortgage for their first home?

Job Interview: I view hiring a mortgage broker as applying for a job. You probably can recall going for a job interview, where the interviewers asked lots of questions and based on your answers (and references) got a gut feel for you. Hiring a mortgage broker is the same, use the above information to ask questions and get a good gut feel for who you should hire. You are trusting a professional with hundreds of thousands of dollars.

If you are buying your first home, an investment property or you are self employed and looking to interview a professional mortgage broker, please contact me.

3 Tips When Renewing Your Mortgage

I have to share this personal experience since it resembles what I deal with on a daily basis with my mortgage clients. My home and auto insurance policies have been with a company for years now until I got my renewal letter a few weeks ago. The jump in insurance premium caught my attention especially since my wife and I are responsible drivers: we have 2 young children, and our records have been impeccable; no tickets, no violations, no accidents.....Usually I get my renewal, go through it to ensure there aren't major changes, the price is reasonable based on the previous premium and then renew.

Sounds familiar? You get your mortgage renewal, too busy with kids, work and life, numbers look ok and you renew? I wasn't happy with the increase in premium and decided to look around.

I tried a price comparison site which provided a low price but after connecting with the insurance company it turned out the information transferred to them from the rate site was inaccurate and the quoted price was invalid; it was higher.

Sounds familiar? You check out a mortgage rate site to find out the rates being quoted are for 30 day closings, have restrictive conditions, not valid for rental properties, you can't refinance the mortgage in the future.....and the list goes on.

By investing some time I saved 25% off what was offered by the existing insurance company.

3 Mortgage Renewal Tips

Don't sign the renewal letter sent by your incumbent lender

Rate sites provide a number but don't tell the full story

Take the time to consult with a professional, it could save you thousands of dollars

In my business, new and repeat clients are provided with superior service and their business is never taken for granted. I don't understand why some businesses take their existing clients for granted.

If your mortgage is up for renewal, you don't want to be taken for granted and looking for professional unbiased advice, please contact me.

Investment Property Mortgage Qualifications Don't Make Sense!

There have been many changes with respect to mortgage qualifications in Canada. Above and beyond the 4 major changes announced by the Minister of Finance over 4 years, there have been changes on the backend on how lenders qualify applicants. The most recent one is mind boggling!

Investment Property Mortgage Qualification

For an applicant reporting a surplus on their T1 general (line 126), the surplus (line 126) is added to their income.

Example: Applicant's income is $100,000 and line 126 is showing $5,000, total applicant's income is $105,000. If the applicant owns other investment properties, here is the part that makes no sense: The principal portion off the annual mortgage statement is deducted from applicant's income!

Example: Applicant has paid down $10,000 of mortgage principal in the previous year, total income: $100,000 plus $5,000 less $10,000 = $95,000. This rule effectively penalizes real estate investors who build equity in their investment properties. Last time I checked statements made by Minister of Finance, Bank of Canada, Bankers..... they all advocate paying down debt and building equity now while interest rates are low (Canadians are at record high debt to income ratio).

This rule effectively encourages not paying down mortgage principal. Had the applicant paid more interest than principal in the previous year, the mortgage principal deduction would have been less and therefore their net income higher!

If you are thinking of showing a loss on line 126, it's even worse: Income less loss on line 126 less mortgage principal.

Are you confused and frustrated with all these guidelines? Rest assured this is what I do on a daily basis and I am here to help you navigate through the mortgage qualification land mines to build your real estate investment portfolio. It's all in the setup.....Happy Investing!

How To Mortgage 8 Investment Condos

There is no denial it is more challenging today to mortgage investment condos in Toronto. Some of the changes over the recent years are:

The days of 5% downpayment and 40 years amortization are long gone

Some lenders have a minimum square footage requirement

Some lenders require more than 20% downpayment

Some lenders require borrower pay for insurance premium above 65% loan to value

and the list goes on. But don't be discouraged. Here is mortgage underwriting 101 and a road map to help the investor mortgage 8 Toronto investment condos:

1. Start With The End Goal

The mortgage setup of each investment condo plays a critical role in helping or hindering the qualification of the next investment condo. Knowing what the investor's ultimate goal (8 condos or 3 condos) requires a different mortgage financing strategy. Some investors approach investment properties with "I'll buy another one" which is a problem in today's financing world. Over the years, I have come across many situations where the mortgage was setup with a short amortization period or the wrong mortgage product which restricted qualifying for another property.

2. Focus On Cash Flow

Setting up each condo to positive cash flow helps to qualify the next investment condo. There are 4 methods of cash flow analysis lenders would consider in mortgage qualification:

T776 Statement of Real Estate Rentals

Some lenders would use line 9946 to add to investor's income if the figure is positive. This is where many investors go wrong. They try to show a loss which reduces taxable income however it hinders qualifying for the next investment condo since the negative figure translates into a liability on the mortgage application. Showing a positive figure and paying some taxes is not a bad thing!

50% of Rental Income

This method is a deal killer. For example, assuming the investment condo is rented for $1600 per month, the lender would only use $800 as revenue then deduct 50% of condo fees and mortgage payment. Good luck getting a positive number without a large downpayment.

Rental Surplus Calculator

Lenders use the rental income generated by the condo and deduct mortgage payment, condo fees and 15% of the rental income figure.

The Wash Method

This is where the lender would look at the rental income being generated and as long as the rental income covers mortgage payment, condo fees and property taxes, the investment condo would not help or hinder in qualifying for a mortgage.

Stretching the amortization to 30 or 35 years and getting a variable mortgage would increase cash flow and help qualify the next investment condo. In real estate it is location, location, location and in the investment property mortgage world it is cash flow, cash flow, cash flow which sometimes means a greater than 20% downpayment.

Keep in mind today's qualification guidelines could be different next month. The mortgage financing landscape changes frequently based on government requirements and lenders' risk analysis. So what works today, might not work tomorrow!

Mortgage Broker or Bank

Most, not all, lenders have a cap of 4 investment properties per borrower. Understanding where the investor wants to be long term helps in structuring the mortgages appropriately and placing them with lenders who accept a portfolio of more than 4 investment condos. Choosing an experienced mortgage professional who knows where and how to place these mortgages can save the investor tens of thousands of dollars. No investor wants to be in a situation where they walk into the bank to finance their 5th investment condo and get "sorry, we can't help you since you are capped". Then what?

Looking to invest in Toronto condos or have an existing portfolio? Please contact Nawar to help you achieve your long term goals.

I Dislike Mortgage Pre-Approvals And You Should Too

Toronto's real estate spring market is about to get started or some might argue it has already begun with a semi-detached in The Junction selling for $210,000 over asking with 32 offers, yes 32 offers! The spring real estate market is the hot season where most transactions are made since many buy in the spring with closings in the summer before schools start in September. One thing you will hear many times from real estate agents, mortgage brokers and bankers is "Get Pre-Approved". I dislike mortgage pre-approvals for the following reasons:

1. Pre-Approvals Underwriting

Pre-approvals are underwritten conservatively relative to an actual deal. The Gross Debt Service Ratio (GDS) and Total Debt Service Ratio (TDS) requirement for pre-approvals is 32/40, however real deals can go up to 39/44. This means a pre-approval purchase value will be lower than what a buyer can qualify for.

2. Interest Rate Variations

This is where things get really tricky. Some lenders add a premium (safety buffer) to pre-approvals, typically 0.1%, since they do not know the exact cost of funding off the bond market until there is a deal with a closing date. Furthermore, lenders have different rates based on:

Closings within 30 days, 45 days or 120 days

Deals that are insured (less than 20% downpayment)

Features built into the mortgage (fully loaded vs no frills mortgage)

Occupancy of property: owner occupied or rental

Some lenders won't do pre-approvals

Get Pre-Qualified

What I do with all my buyer clients is get them pre-qualified per the following steps:

Complete financial analysis and mortgage application

Establish a monthly cash flow budget

Get a rate hold in a rising interest rate environment

When they see a property they want to put an offer on, I complete the mortgage qualification analysis based on the property details to establish a maximum price for a bidding war scenario

The fourth step is critical since my clients are emotionally ready to walk away from a property after they have established the maximum price they are willing to pay. So far, they have been quite successful.

In conclusion, pre-approvals are nothing more than a rate hold which is a good thing to obtain in a rising interest rate environment which doesn't look like is happening anytime soon.

If you are looking to dive into Toronto's hot real estate market and win a bidding war, please contact Nawar.

Is Toronto's Real Estate Affordable?

Sold over asking, bidding war, multiple offers, over asking....These expressions are synonymous with Toronto's real estate. The latest RBC affordability index report came out in November 2013 which shows eroding affordability in the city:

Bungalows: 55.6%

2 Storey: 63.7%

Condos: 33.8%

What do these numbers mean? The affordability index is based on 25% downpayment at 5 year fixed mortgage rate amortized over 25 years. The percentages mean the following: To buy a bungalow, 55.6% of one's pre-tax income is required to cover the mortgage, property tax and utility costs. Assuming homeowner's tax bracket is 40%, this leaves 4.6% (100%-55.6%-40%) to cover the costs of food, transportation, entertainment, emergency and any child care costs. Clearly in Toronto, 2 incomes are required to afford detached and bungalow homes. On the other hand, condos continue to be affordable. Single income homeowner (100%-33.8%-40%) would have 26.2% of their income to cover living costs. This is one reason why the condo market continues to be stable in Toronto.

How To Get Into Toronto's Hot Real Estate Market

Yes, there is hope and options to get into the market. Here are some to consider:

30 & 35 Year Amortization Mortgages

For conventional mortgages (20% or more downpayment), 30 & 35 year amortization mortgages are available. Lower monthly payments would make the home more affordable, however planning for renewing into a higher interest rate environment is important. An extended amortization mortgage backed by the inflation hedge mortgage strategy is a sound financial approach.

Basement Rental Suite

Renting the basement has its pros and cons. Offsetting homeownership costs is a benefit and makes the home more affordable, however some aren't comfortable with someone living in the same house due to noise concerns and/or loss of space. Basement rental income can range from $750-$1400 depending on location and condition.

Legalizing Basement Rental Apartments

Combining both options is a possibility for frustrated homebuyers who are tired of losing bidding wars. To discuss your mortgage options and strategies, please contact Nawar.

Legalizing Basement Rental Apartments

Basement rental apartments are popular in Toronto and make homes affordable for many in the city since they have the potential of generating $1000-$1500 per month in rental income. Legalizing a basement apartment requires meeting electrical, fire and building codes. It seems daunting initially but working with a knowledgeable architect can alleviate lots of headaches. As a real estate investor, I have viewed many properties and found the most challenging part of legalizing a basement apartment to be the ceiling height requirement. There are 2 building code requirements; one for existing basement units and one for new basement units. If the basement rental apartment is existing, the code requires at least 50% of the floor area to be 6'5" high. If the basement rental apartment is new, the code requires at least 50% of the floor area to be 6'8" high. The majority of homes' basements built in the city of Toronto were used as utility /storage areas and not as living space. Nowadays, basements are considered part of the living space for in-home offices, guest bedrooms, children's play area and entertainment space. Lowering the flooring to achieve legal height can be accomplished through underpinning or benching. Both methods can be costly depending on the house foundation conditions, soil conditions and existing interior walls. In cases where the basement ceiling height is 4"-6" below the required height, there is a third more cost effective option: lowering concrete slab (see image below).

A bonus of this option is installing new PVC drains since the old ones are made out of clay and over the years have deteriorated in condition. This method requires drilling holes into the existing concrete slab to locate it relative to the wall footing. In my experience, I had to underpin one property and managed to lower the concrete slab on another to achieve required legal basement height. The cost of underpinning can range between $50-70,000 where as concrete slab lowering $15-20,000.

References For Adding A Secondary Unit in Toronto

- Carson Dunlop Basement Apartments Untangling the Web

- Second Suites

- Basement Accessory Apartment Specifications

If you are looking for an experienced mortgage broker to help you navigate through adding a basement rental apartment and analyze the investment property, please contact me.

**Disclaimer: The above information is for reference only and it is best to consult with a professional architect and a licensed basement lowering company as part of your due diligence**

US Government Shutdown & Variable Mortgages

Another self inflicted US crisis is underway; the US Government has shutdown as of October 1, 2013 and overnight 800,000 Americans have lost their jobs. To put this in perspective, imagine the whole population of Mississauga and Oakville being unemployed overnight!

Canada's Prime Rate Impact

How does this chaos affect Canada's mortgage rates?

US Federal Reserve is committed to its bond buying stimulus program till unemployment is at 6.5%. Currently, unemployment in the US is at 7.3% and with 800,000 Americans losing their jobs and the ripple effect of small businesses that do business with the US Government, the unemployment rate will increase if the shutdown is prolonged hence would force the US Federal Reserve to maintain its stimulus program and ultra low benchmark rate (prime rate)

Bank of Canada's second in command, Tiff Macklem, said this week the Bank of Canada is lowering its outlook for Canadian GDP for this year and 2014

August's core inflation was at 1.3%, well below Bank of Canada's target of 2%

Bank of Canada's benchmark rate cannot deviate far off US Federal Reserve benchmark rate since it would result in a higher Canadian dollar which negatively affects exports, i.e, bad for the economy

With the prospect of the benchmark rate (prime rate) holding steady for one to two years, the case for variable mortgages is stronger today. There are two catches however:

Applicant has to qualify based on the posted 5 year rate, which is at 5.34% today.

If US Government defaults mid October, we all remember what happened in 2008 when the financial market seized and costs of borrowing spiked since no one was willing to lend money (supply of money disappeared overnight), cost of borrowing would increase.

If you are looking for professional mortgage advice based on facts, numbers and detailed analysis, please contact Nawar.